Money and Credit

Class 10th Social Science- Money and Credit

MONEY AND CREDIT

NCERT TEXTBOOK

QUESTIONS

Q.1. List the various sources of credit in Sonpur.

Ans.

There are various sources of credit which are available in Sonpur.

These are as follows :

(i) agricultural

traders (ii) moneylenders (iii) commercial banks

(iv) cooperative

societies (v) relative and friends etc.

Q.2. Look at a 10-rupee note. What is written on the top? Can you explain this?

Ans.

Reserve Bank of India (Guaranteed by the Central Government) is

written on a 10-rupee note.

This statement

means that the Central government has authorised the Reserve Bank of India

to issue this

note on behalf of the Central government.

Q.3. Write the functions of money.

Ans.

Money acts as a common medium of exchange, a common measure of value,

a standard of

deferred

payments and a store of value.

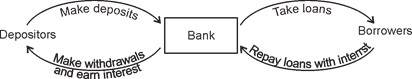

Q.4. How do banks mediate between those who have surplus money and those who

need

money?

Ans.

Banks collect surplus money with people, as deposits. Banks use a

major portion of these

deposits to

extend loans. There is a huge demand for loans by businessmen and industrial

houses for

various economic activities. Banks may use the deposits to meet the loan

requirements of

the people. In this way, banks mediate between those who have surplus funds

(the depositors)

and those who are in need of these funds (the borrowers) and banks charge

a higher interest rate on loans

than what they offer on deposits.

Q.5. Modern currency is without any use of its own as a commodity. Why is it

accepted as

money?

Ans.

Modern forms of money include paper notes and coins. Modern currency

is neither made of

precious metals

such as gold, silver and copper nor consists of daily use commodities. The

modern currency

is without any use of its own.

It is accepted

as a medium of exchange because the currency is authorised by the government

of a country.

Q.6. Why are banks willing to lend to women organised in self-help groups

(SHGs)?

Ans.

Non-payment of loan by any member of the group is followed up

seriously by other members

in a group.

Because of this feature, banks are willing to lend to the poor women of SHGs,

even

though they have

no collateral as such.

Q.7. Why do you think that the share of formal sector credit is higher for the

richer

households, compared to the poorer households?

Ans.

The share of formal sector credit is higher for the richer households

because they can deposit

the collaterals

(security) such as land, building, livestock etc. while it is difficult for the

poorer

households

because of non-availability of such collaterals.

Q.8. Compare the terms of credit for the small farmer, the medium farmer and the

landless

agricultural worker in Sonpur.

Ans.

|

Small farmer |

Medium farmer |

Lendless agricultural worker |

|

Small farmers

generally take loan either from

moneylenders or from agricultural

traders. The rate of interest is very

high but neither collateral nor documentation is required for taking loan. |

For medium farmers

credit facilities are also available from banks at a very reasonable rate of interest. Repayment terms are flexible but in the process of getting credit, documentation and collateral is required. |

Being a landless

agricultural worker he remains idle

several months in a year. To meet his

contingent requirements (in case

of illness, or festivals) he

has to borrow credit form moneylender at a very high rate.

These workers are exploited by these moneylenders. |

Q.9. In India, about 80% of farmers are small farmers who need credit for

cultivation.

(a) Why might

banks be unwilling to lend to small farmers?

(b) What are the

other sources from which the small farmers can borrow?

(c) Explain with

an example how the terms of credit can be unfavourable for the small farmers.

(d) Suggest some

ways by which small farmers can get cheap credit.

Ans.

(a) As the small farmers find it difficult to provide necessary

documents / formalities and

collateral

security required for loan, so these banks might be unwilling to lend to small

farmers.

(b) Informal

sources of credit like moneylenders, employers, relatives, friends etc. are the

sources from

which small farmers borrow the credit.

(c) If higher

rate of interest is carried as terms of credit from informal sources, then it

would

be unfavourable

for the small farmers.

(d) Farmers can get cheap credit

through cooperatives and SHGs

Questions in the Exercise

Q.1. Self-help groups also discuss the following social problems.

(a) Health (b)

Nutrition (c) Domestic violence (d) All the above

Ans.

(d)

Q.2. In SHG most of the decision regarding savings and loan activities are taken

by

(a) Bank (b)

Members

(c)

Non-government organisations (d) Government.

Ans.

(b)

Q.3. Fill in the blanks :

(i) Majority of

the credit needs of the _______________ households are met from informal

sources.

(ii)

_____________ cost of borrowing increases the debt burden.

(iii)

_____________ issues currency notes on behalf of the Central Government.

(iv) Banks

charge a higher interest rate on loans than what they offer on _______________

(v)

______________ is an asset that the borrower owns and uses as a guarantee until

the loan

is repaid to the

lender.

Ans.

(i) rural (ii) higher (iii) RBI (iv) deposits (v) collateral

Q.4. In situations with high risks, credit might create further problems for the

borrower.

Explain.

Ans.

The areas like farming, where high risks are involved, crop failure

make loan repayment

impossible. To

repay the loan amount, farmers have to sell a portion of their land. In such a

situation credit

pushes the person into a debt-trap from which recovery is very painful.

Q.5. Why do lenders ask for collateral while lending?

Ans.

Generally lenders ask for collateral, which is an asset that the

borrower owns (such as land,

building,

vehicle, livestock etc.) and uses this as a guarantee to a lender until the loan

is repaid. If

borrower fails

to repay the loan, the lender has the right to sell the collateral to obtain

payments.

Q.6. In what ways does the Reserve Bank of India supervise the functioning of

banks? Why

is it necessary?

Ans.

The Reserve Bank of India supervises the functioning of formal

sources of loan. For example,

we have seen

that the banks maintain a minimum cash balance out of the deposits they receive.

The RBI monitors

that the banks actually maintain the cash balance. Similarly, the RBI sees

that the banks

give loans not just to profit making businesses but also to small cultivators,

small scale

industries etc.

Q.7. Manav needs a loan to set up a small business. On what basis will Manav

decide whether

to borrow from a bank or a moneylender? Discuss.

Ans.

If Manav has all the necessary documents showing his paying capacity

and collateral security

then he will go

in for a formal source of credit, i.e. bank. Bank will charge a reasonable rate

of interest. If

he cannot provide necessary documents required for loan from the bank, then he

has to opt for

an informal source of credit who sometimes lends at higher rate of interest and

uses unfair means to get back the

money.

PREVIOUS YEARS’

QUESTIONS

Q.1. Which are two major sources of formal sector credit in India? Why do we

need to expand

the formal sources of credit?

Ans.

Formal sector credit in India includes loans from banks and

cooperatives. RBI supervises their

functions of

giving loans. Lower rate of interest is charged as compared to informal sources

of credit on

these loans.

Need to expand formal sources of credit :

Formal sector credit

needs to be expanded in India

so as to save

people and especially poor farmers and workers from exploitation of the informal

sector credit.

Formal sector lends at a reasonable rate of interest which is very cheap. Formal

credit can fulfil various needs of

the people through providing cheap and affordable credit.

MULTIPLE CHOICE

QUESTIONS

Q.1. System of exchanging goods for goods is called :

(a) monetary

system

(b) credit

system

(c) barter

system

(d) exchange

system

Ans.

(c)

Q.2. Money

(a) eliminates

double-coincidence of wants

(b) acts as a

common measure of value

(c) acts as a

standard of deferred payments

(d) all the

above

Ans.

(d)

Q.3. At present which form of money is increasingly used apart from paper money?

(a) Commodity

money

(b) Metallic

money

(c) Plastic

money

(d) All the

above

Ans.

(c)

Q.4. What are the modern forms of money?

(a) Currency

(b) Plastic

money

(c) Demand

deposits (d) All the above

Ans.

(d)

Q.5. Terms of credit are with respect to :

(a) interest

rate (b) collateral

(c)

documentation (d) all the above

Ans.

(d)

Q.6. Credit or loan refers to an agreement

between :

(a) lender and

borrower

(b) consumer and

producer

(c) government

and tax payer

(d) all the

above

Ans.

(c)

Q.7. The formal sector meets only about _______ of the credit needs of rural

people :

(a) 25% (b) 52%

(c) 75% (d) 15%

Ans.

(b)

Q.8. The part of the total deposits which a bank keeps with itself in cash is

(a) zero

(b) a small

proportion

(c) a big

proportion

(d) 100 percent

Ans.

(b)

Q.9. An asset that the borrower uses as a repayment guarantee to a lender is

termed as a :

(a) deposit (b)

collateral

(c) advance (d)

all the above

Ans.

(b)

Q.10. Currency is issued in India by :

(a) commercial

banks

(b) regional

rural banks

(c) nationalised

banks

(d) Reserve Bank

of India

Ans.

(d)

Q.11. Who supervises the credit activities of lenders in the informal sector?

(a) Central Bank

of India

(b) Commercial

banks

(c) Moneylenders

(d) None

Ans.

(d)

Q.12. Rich households in urban areas avail cheap credit from

(a) formal

sources (b) informal sources

(c) government

(d) all the above

Ans.

(a)

Q.13. Productive loans by farmers are taken

(a) to buy

seeds, fertilisers, implements

etc.

(b) for

celebration of marriages

(c) for storage

of foodgrains in godowns

(d) none of the

above

Ans.

(a)

Q.14. Which of the following is not a source of rural credit?

(a) Regional

rural banks

(b) Moneylenders

(c) Traders

(d) Government

Ans.

(d)

Q.15. Rate of interest charged by moneylenders as compared to that charged by

banks is :

(a) lower (b)

same

(c) slightly

higher (d) much higher

Ans.

(d)

Q.16. Regional Rural Banks were set up in

________.

(a) 1969 (b)

1979

(c) 1989 (d)

1999

Ans.

(a)

Q.17. A Self-Help Group usually has :

(a) 5-10 members

(b) 10-15 members

(c) 15-20

members (d) 20-25 members

Ans.

(c)

Q.18. When was the KCC (Kisan Credit Card) scheme introduced?

(a) 1969 (b)

1979

(c) 1987-88 (d)

1998-99

Ans.

(d)

Q.19. Which state accounts for maximum percentage of SHGs (self-help groups) in

bank credit?

(a) Andhra

Pradesh (b) Tamil Nadu

(c) Kerala (d)

Karnataka

Ans.

(a)

Q.20.

_________ are widely accepted as a medium of exchange.

(a) Rupee notes

(b) Gold coins

(c) Silver coins

(d) All the above

Ans.

(a)

Q.21. Majority of the credit needs of the poor households are met from

(a) formal

sources

(b) informal

sources

(c) self-help

groups

(d) none of the

above

Ans.

(b)

Q.22. Who supervises the functioning of formal sources of loans?

(a) RBI (Reserve

Bank of India)

(b) Central

government

(c) State

government

(d) None

Ans.

(a)

Q.23. Which of the following is a major reason which prevents the poor from

getting bank loans?

(a) Absence of

collateral (security)

(b)

Non-repayment of loans

(c) Higher

interest rates

(d)

Documentation

Ans.

(a)

Q.24. Who helps the borrowers to overcome the problem of lack of collateral?

(a) Self-help

group (SHG)

(b) State

government

(c) Employers

(d) Moneylenders

Ans.

(a)

Q.25. Formal sources of credit include

(a) banks (b)

moneylenders

(c) employers

(d) all the above

Ans.

(a)

Q.26. Which of the following is not a modern form of money?

(a) Paper notes

(b) Demand deposits

(c) Silver coins

(d) None of the

above

Ans.

(c)

PREVIOUS YEARS’

QUESTIONS

Q.1. Which of the following is not an advantage of self-help group?

(a) Grant of timely loans

(b) Reasonable

interests

(c) A platform

to discuss various issues

(d) Does not

help women to become self-reliant.

Ans.

(d)

Q.2. What do you mean by collateral?

(a) It is the total sum of money with a

person

(b) It is the

things kept in the locker

(c) It is the

guarantee given by the lender to the borrower.

(d) It is the

security to a lender until the loan is repaid

Ans.

(c)

Q.3. Identify the formal source of credit.

(a) Cooperative societies

(b) Moneylenders

(c) Traders

(d) Landlords

Ans.

(a)

Q.4. Which one of the following is not a modern form of money?

(a) Demand

Deposits

(b) Paper

currency

(c) Coins

(d) Precious

metals

Ans.

(d)

Q.5. Which one of the following authorizes money as a medium of exchange?

(a) Reserve Bank of India

(b) Self Help

Groups

(c) The Central

Government

(d) The

President of India.

Ans.

(a)

Q.6. Which of the following is not true regarding the in convenience of Barter

Exchange ?

(a) Lack of

double coincidence of want

(b) Absence of

divisibility

(c) Difficulty

in storing wealth

(d) Availability

of money as a medium of

exchange.

Ans.

(d)

Q.7. Which one of the following is NOT an informal sector loans for poor rural

household in India ?

(a) Commercial

Banks

(b) Moneylenders

(c) Traders

(d) Landlords

Ans.

(a)

Q.8. Which one of the following is the important characteristic of modern form

of currency?

(a) It is made

from precious metal

(b) It is made

from thing of everyday use

(c) It is

authorized by the commercial banks

(d) It is

authorized by the Government of the country

Ans.

(d)

Q.9. Which one of the following constitutes money in modern day economy?

(a) Gold (b) Silver

(c) Interest (d)

Demand Deposits

Ans.

(d)

Q.10. In a SHG most of the decisions regarding loan activities are taken by

(a) Banks (b) Member

(c)

Non-government organizations

(d) Cooperatives

Ans.

(b)

Q.11. Which one of the following is a major reason that prevents the poor from

getting loans from the banks?

(a) Lack of capital

(b) Not

affordable due to high rate of interest

(c) Absence of

collateral security

(d) Absence of

mediators

Ans.

(c)

Q.12. Which one of the following agencies issues currency notes on behalf of the

government of India ?

(a) Ministry of

Finance

(b) Reserve Bank

of India

(c) State Bank

of India

(d) World Bank

Ans.

(c)

Q.13. Formal Sources of credit include :

(a) money lenders (b) co-operatives

(c) Employers

(d) Finance

companies

Ans.

(b)

Q.14. Anything which is generally accepted by the people in exchange of goods

and services is called :

(a) money (b)

barter

(c) credit (d)

loans

Ans.

(b)

Q.15. Terms of credit does not include :

(a) interest

rate (b) collateral

(c) cheque (d)

mode of repayment

Ans.

(c)

Q.16. Banks do not give loans :

(a) to small

farmers

(b) to marginal

farmers

(c) to

industries

(d) without

proper collateral and

documents

Ans.

(d)

Q.17. The functioning of the formal sources of credit are supervised by :

(a) Government

of India

(b) Reserve Bank

of India

(c) Ministry of

finance

(d) State Bank

of India

Ans.

(b)

Q.18. Which one of the following is NOT a formal source of credit?

(a) Commercial

Banks

(b) State Bank

of India

(c) Employers

(d)

Co-operatives

Ans.

(c)

Q.19. Which one of the following is not included in the terms of credit?

(a) Rate of

Interest

(b) Mode of

payment

(c) Rate of

saving

(d) Collateral

Ans.

(c)

Q.20. Which is not the main source of credit from the following for rural

households in India ?

(a) Traders

(b) Relatives

and friends

(c) Commercial

Banks

(d) Money

landers

Ans.

(a)

Q.21. Cheap and affordable credit results in which one of the following ?

(a) Slow

economic growth

(b) Creating a

debt trap

(c) Poverty

(d) Good

economic growth

Ans.

(d)

Q.22. Deposits in bank accounts withdrawn on demand are called :

(a) Fixed

deposit

(b) Recurring

deposit

(c) Demand

deposit

(d) None of

these

Ans.

(c)

Q.23. Banks use the major portion of the deposit to :

(a) Keep reserve

so that people may withdraw

(b) Meet their

routine expenses

(c) Extend loans

(d) Meet

renovation of the bank

Ans.

(c)

Q.24. When both parties agree to sell and buy each other’s commodities it is

known as :

(a) measure of

value

(b) double

coincidence of wants

(c) store of

value (d) credit

Ans.

(b)

Q.25. Which among these is an essential feature of barter system ?

(a) Money can

easily exchange any commodity

(b) It is based

on double co-incidence of wants

(c) It is

generally accepted as a medium of exchange of goods with money

(d) It acts as a

measure and store of value

Ans.

(b)

Q.26. Which one of the following is the main source of credit for the rich

households?

(a) Informal

(b) Formal

(c) Both formal

and informal

(d) Neither

Formal nor informal

Ans.

(b)

Q.27. Why bank deposits are known as demand deposits ?

(a) Deposits

with the banks

(b) People have

the provision to withdraw the money when they require.

(c) Deposits

with the banks cannot be withdrawn.

(d) People have

the provision to withdraw the money only by cash.

Ans.

(b)

Q.28. Which households take more loans from the formal sector ?

(a) Poor

households and rich household.

(b) Well off

households and households with few assets.

(c) Poor

households and well off households

(d) Well off

households and rich households.

Ans.

(d)

Q.29. What portion of deposits are kept by the banks for their day to day

transaction ?

(a) 10% (b) 15%

(c) 20% (d) 25%

Ans.

(b)

SHORT ANSWER TYPE QUESTIONS

Q.1. Can everyone in Sonpur get credit at cheap rate? Who are the people who

can?

Ans.

No, not everyone in Sonpur can get credit at cheap rates.

Generally some

medium farmers, who are literate and have their own land for cultivation, get

credit at cheap

rates from banks.

Q.2. Write two main functions of a commercial bank.

Ans.

Accepting deposits from the individuals and providing loans to the

entrepreneurs are the two

main functions

of a commercial bank.

Q.3. Why should credit at reasonable rates be available for all?

Ans.

If credit is available at reasonable rate, this would lead to higher

income and many people

could then

borrow for a variety of needs such as for growing crops, for setting small scale

industries, for

business etc. Thus credit at reasonable rate will be helpful in the development

process of a

country.

Q.4. What do you understand by “terms of credit”?

Ans.

Interest rate, collateral and documentation requirement, and the mode

of repayment together

are called the

terms of credit.

Q.5. How is credit helpful for the country’s development?

Ans.

Large numbers of transactions in our day to day activities involve

credit in some form or the

other. Credit

helps people to meet the ongoing expenses of production, complete production

on time and

thereby increase their earnings. Hence, it plays a vital and positive role in a

country’s

development.

Q.6. What is the basic idea behind the SHG’s for the poor? Explain in your

words.

Ans.

The basic idea behind the SHG’s for the poor is to provide credit

facilities at a cheaper rate

and also without

much documentation process.

An SHG has 15-20

members, usually from the neighborhood, who meet and save regularly

in the range of

Rs 25 to Rs 100 or more. The amount which is collected by an SHG is utlised

to give loan to

a member of the group. Now the group decides as regards the loans to be

granted, the

purpose, amount, interest to be charged, and its repayment schedule.

Q.7. Why do we need to expand formal sources of credit in India?

Ans.

Formal sources of credit in India provide loans to individuals at far

cheaper rates than informal

sources of

credit. This helps to increase their income and they are able to repay the

principal

amount as well

as interest by parting with a small part of their higher income. It will lead to

more production.

This helps in the economic development of a country.

Q.8.

What is the main source of income for banks?

Ans.

The main source of income for banks is the difference between

interest rate charged from

borrowers and

what is paid to depositors. After keeping a portion of deposits as reserves

banks

lend to people

who demand money as loan and bank charges interest from them.

PREVIOUS YEARS’ QUESTIONS

Q.1. What do the banks do with the 'Public Deposits'? Describe their working

mechanism.

Ans.

Banks accept deposits from the Public and use the major portion of

these deposits to

extend loans.

There is a huge demand for loans for various economic activities. Banks

make use of

these deposits to meet the loan requirement of the people and thereby earn

interest. This

is, infact, the main source of income of the bank. In this way, bank acts as

a mediator

between those who have surplus funds (the depositors) and those who are in

need of these

funds (the borrowers). Banks charge a higher interest rate on loans than what

they offer on

deposits.

Q.2. What are demand deposits? Describe any three salient features of demand

deposits.

Ans.

People with surplus money or extra amount deposit it in banks. The

banks keep the money safe

and give an

interest on it. The deposits can be drawn at any time on demand by the

depositors.

That is why they

are called 'demand deposits'.

(i) The demand

deposits encashable by issuing cheques have the essential features of money.

(ii) They make

it possible to directly settle payments without the use of cash.

(iii) Since

demand drafts/cheques are widely accepted as a means of payment along with

currency, they

constitute money in the modern economy.

Q.3. Mention any three points of distinction between formal sector loan and

informal sector loan.

Ans.

Formal Sources of Credit

Informal sources of

Credit

1. Formal

sources of credit are generally

1. Informal sources of credit are

generally

provided by

banks and cooperatives.

provided by moneylenders,

traders,

employers, relatives and friends.

2. Interest rate

for repaying loans is lower.

2. Interest rate for repaying loans is

costlier.

3. RBI

supervises the functioning of formal

3. In informal sector no such organisation

sources of loan

and also ensures that these

is there to supervise the credit

activities

facilities

should also be given to small

of lenders that they used to

charge higher

cultivators and

small borrowers.

rate of interest on loans.

LONG ANSWER TYPE QUESTIONS

Q.1. Differentiate between Reserve Bank of India RBI and Commercial Bank.

Ans.

Reserve Bank of India

Commercial Bank

1. It has the

sole monopoly right to issue

1. No such thing is done by commercial bank.

currency notes.

2. It is the

apex bank in the money market

2. It is a unit in the banking structure of the

country.

of a country.

3. It does not

deal with the public.

3. It directly deals with the public and

business firms.

4. It acts as a

banker to the government.

4. It has no such responsibility towards the state.

PREVIOUS YEARS’ QUESTIONS

Q.1. Explain any two

features each of formal sector loans and informal sector loans.

Ans. Formal Sector Loans :

Formal sector

loans include loans from banks and cooperatives. Features of formal sector

loans are :

(i) Formal

sectors provide cheap and affordable loans and their rate of interest is

monitered

by RBI.

(ii) Formal

sector strictly follows the terms of credit which includes interest rate,

collateral,

documentation

and the mode of repayment.

Informal Sector Loans :

Informal sector

loans include loans from moneylenders, traders, employers, relatives, friends

etc. Features

for informal sector loans are :

(i) Their credit

activities are not governed by any organisation, therefore they charge higher

rate of

interest.

(ii) Informal

sector loan providers know the borrowers personally, and hence they provide

loans on easy

terms without collateral and documentation.

Q.2. What are the two main reasons for formal credit not being available to the

rural

poor ? Why is there a need to expand rural credit ?

Ans.

The two main reasons for formal credit not being available to rural

poor are :

(i) Absence of

collateral and documentation is the main reason which prevents rural poor from

getting bank

loans.

(ii) The

arrangements of informal sector loans are flexible in terms of timelines,

procedural

requirements,

interest rates etc. They are adjustable according to the needs and

convenience of

the borrower.

There is a need

to expand rural credit from the side of formal sector because :

(i) Informal

sectors exploit rural poors by putting them in debt-traps.

(ii) Cheap and

affordable credit for rural poors is important for the country’s overall

development.

Q.3. Why do the rural borrowers depend on the informal sector for credit? What

steps can

be taken to encourage them to take loans from the formal sources ? Explain any

two.

Ans.

The rural borrowers depend on the informal sector for credit because

:

(i) Absense of

collateral and documentation with rural borrowers.

(ii) Flexible

loans in term of timelines, interest rates, procedural requirements etc. are

provided

to rural

borrowers by informal sectors.

Steps that can

be adopted to encourage them to take loans from the formal sources are :

(i) Awareness

among rural borrowers against the exploitation of informal sectors. Need to

aware them

regarding high rate of interest and debt traps made by such moneylenders.

(ii) Promotion

to self-help groups. These groups collect their savings as per their own ability

to save. Members

can take small loans from the groups to meet their requirements. If the

group is regular

in savings for year or two, it can avail loan from the bank.

Q.4. ‘Cheap and affordable credit is crucial for the country’s development’.

Explain the

statement with four points.

OR

Why do we need to expand formal source of credit in India ? Explain any four

reasons.

Ans.

If the loans are cheap and affordable, this can lead to countries

development in the following

ways :

(i) Cheap loans

results in higher incomes and higher profits which can help in the expansion

of business.

(ii) More and

more people can be benefitted by the loans in their businesses.

(iii) This can

help in making more and more agricultural activities, small-scale industries

etc.

Credit can be

distributed more equally which helps in benefitting the poor’s by the help of

cheaper loans.

Q.5. Answers the following questions :

(a) Why are

banks unwilling to lend loans to small farmers ?

(b) Besides

banks, what are the other sources of credit from which the small farmers can

borrow.

(c) Explain how

terms of credit can be unfavorable for the small farmers.

(d) From where

can small farmers get cheap loans ?

Ans.

(a) Banks provide loans after collateral and documentation

securities, which generally the

small farmers

failed to comply with. Therefore, banks are unwilling to lend loans to small

farmers.

(b) There are

several informal sources of credit like landlords, moneylenders, traders,

relatives and

friends etc.

(c) Terms of

informal credit can put the small farmers into debt-traps. Higher rate of

interest

and unfavorable

conditions exit farmers by the situation of multiple loans.

(d) Farmers can

get cheap and safe loans from formal credit providers i.e., banks and

cooperative

societies.

Q.6. Which are the two major sources of formal sector credit in India ? Why do

we need to

expand formal sources of credit ?

Ans.

The two major sources of formal sector credit in India are —

commercial banks and

cooperative

societies.

We need to

expand formal sources of credit due to following reasons :

(a) Informal

sources of credit exploit the poor’s resulting in putting them into debt-traps.

(b) Formal

sources of credit are cheaper and thus they help in country’s development.

Q.7. What is meant by term of credit ? What does it include ?

Ans.

Terms of credit are the requirements need to be satisfied for any

credit arrangements. It

includes

interest rate, collateral, documentation and mode of repayment. However the

terms of

credit vary

depending upon the nature of lender, borrower and loan.

Q.8. How does the Reserve Bank of India supervise the functioning of banks? Why

is this

necessary?

Ans.

Reserve Bank of India (RBI) supervised the banks in the following

ways :

(i) It monitors

the balance kept by banks for day-to-day transactions.

(ii) It checks

that the banks give loans not just to profit-making businesses and traders but

also

to small

borrowers.

(iii)

Periodically banks have to give details about lending, borrowers and interest

rate to RBI.

It is necessary

for securing public welfare. It avoids the bank to run the business with profit

motive only. It

also keeps a check on interest rate of credit facilities provided by bank. RBI

makes sure that

the loans from the banks are affordable and cheap.

Q.9. Describe four features of Self-Help Group (SHG).

Ans.

The features of Self-Help Group (SHG) are :

(i) People form

their personal groups for the purpose of savings and also lend money among

themselves.

(ii) Rate of

interest is lower than informal service providers.

(iii) They can

also avail loans from banks if their savings are regular.

(iv) Decisions

regarding the savings and loan activities are taken by group members.

Q.11. What is double coincidence of want? How has money solved this problem?

Ans.

Things exchanged for other things without the use of money is known

as barter system. The

barter system

laid the foundation of trade but trade was limited to the bounds of a village or

town. Hence, in

a barter system when both the parties agree to sell and buy each other’s

commodities, it

is known as double coincidence of wants. Whatever commodity a person

desires to sell

is exactly what commodity the other wishes to buy. Without double coincidence

of wants

exchange of goods is not possible. Therefore, it is an essential feature.

Money eliminates

the need of double coincidence of wants. One can easily exchange their

goods in

exchange of money and later on pay money for the desired commodities. Money acts

as a

intermediate in the process of exchange, it is called as medium of exchange.

Q.12. How do banks mediate between those who have surplus money and those who

need

money?

Ans.

People keep their surplus money in banks for safety and interest

which is provided by banks

to them. Banks

again keep only a small proportion of their cash with themselves. These days

banks keep only

15% of the total deposits with them. Rest of the money banks keep to extend

loans. Banks

charge interest on loans which is higher than the interest on deposits. This

surplus

interest becomes

the source of income for the banks. The 15% of cash deposits which banks

keep with

themselves helps to carry on with, day-to-day transactions. Like every day,

depositors

come to withdraw some of their

cash.

Q.13. Differentiate

between formal and informal sources of credit.

Q.11.

Ans.

|

Formal Sources |

Informal Sources |

|

1.

Formal sources of

credit are loans from banks and

cooperative societies.

2.

Functioning of formal sources of credit is governed by Reserve Bank of India.

Their interest rate and money lending

details are periodically checked by

RBI.

3.

Rate of interest is common and

fixed for all

formal sources and

borrowers.

4.

Formal sources of

credit needs to

satisfy all the terms of

credit before credit, activities.

5.

They provide cheap and

affordable credit for

both urban and

rural borrowers interest. |

1.

Informal sources of

credit are money-

lenders, traders, employers, relatives, friends etc.

2.

There is no organisation that manages or check the credit activities performed

by informal sources.

3.

Rate of interest depends upon the

choice of moneylenders.

4.

Informal sources of

credit are flexible in

terms of credit.

5.

They generally charge higher rate of |

Q.14. Mention four characteristics each of the formal and informal sources of

credit in India.

Ans. Features of formal sources of credit are :

(a) Formal

sources of credit are provided by banks and cooperative societies to the

borrowers.

(b) Reserve Bank

of India (RBI) governs the functioning of formal source of credit. RBI

periodically

checks the interest rate and other details of these sources.

(c) They follow

proper terms of credit which includes collateral, documentation, rate of

interest and

mode of repayment.

(d) They provide

cheap and affordable credits with common terms of credit for all.

Features of informal sources of credit are :

(a) Informal

sources of credit are moneylenders, traders, employers, relatives, friends etc.

(b) There is no

government or private organization that manages or check the credit activities

performed by

informal sources.

(c) Their terms

of credit are flexible for the personal benefit of the lenders and condition of

borrowers.

(d) They

generally charge higher rates of interest and exploit the borrowers for their

own

benefits.

Q.15. Study the table given below and answer the questions that follow :

PEOPLE DEPENDING ON FORMAL SECTOR CREDIT IN URBAN AREAS

Category

Percentage of people

Poor households

15%

Households with

few assets

47%

Well-off

households

72%

Rich households

90%

(i) Poor

households share of formal credit in the urban areas is low as compared to that

of

rich households.

Why is it so ?

(ii) Mention two

difficulties faced by poor households in taking loan from a formal sector.

Ans.

(i) Poor households share of formal credit in urban areas is low as

compared to that of rich

households due

to the following reasons :

(a) Poor’s

generally lack in collateral guarantors and do not have proper mode of

repayment.

(b) Informal

sources of credit are generally flexible in timings, rate of interest, repayment

schedule etc.

Therefore, it is

easier for poor’s to approach moneylenders as they know them

personally.

(ii) (a) Poor’s

are not able to satisfy general terms of credit mostly collateral guarantees.

(b) Informal

moneylenders know the boor borrowers personally and therefore flexible in

terms of repayment schedule, amount

and interest etc.

Q.16. What are the modern forms of money currency in India? Why is it accepted

as a medium

of exchange? How is it executed?

Ans.

Modern forms of money include currency (paper notes) and coins.

It is accepted

as a medium of exchange because the currency is authorized by the government

of India. No

individual in India can legally refuse a payment made in rupee.

Any person

holding money can easily exchange it with any commodity or service that he

desires. It acts

as intermediate in the exchange process of different countries.

Q.17. Why are transactions made in money? Explain with suitable examples.

Ans.

Money is accepted as a medium of exchange because the currency is

authorized by the

government of

India. In money transactions, money can be paid for any goods or services one

desires. For

example : the producer of shoes may want wheat in exchange for his shoes. But

he may find it

difficult to find a person who is also willing to exchange his wheat for shoes.

So simultaneous

fulfilment of mutual wants is the first and foremost condition to buy and sell

the commodity.

In money transaction one can buy a commodity whenever one wants it. One

does not have to

wait for another person to agree to an exchange of goods.

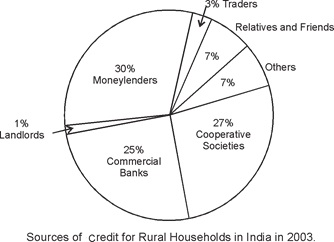

Q.18. Study the diagram

given below and answer the questions that follow :

(a) Which are

the two major sources of credit for rural households in India?

(b) Which one of

them is the most dominant source of credit for rural households?

(c) What is the

most dominant source of credit? Give two reasons.

Ans.

(a) Moneylenders and cooperative societies.

(b) Moneylenders

(c) (i)

Moneylenders do not ask for a collateral.

(ii) Complicated

paper work or documentation is not involved.

Q.19. What are the various sources of credit in rural areas? Which one of them

is the most

convenient source of credit? Why is it most convenient? Give two reasons

Ans.

Various sources of credit in rural areas are : (i) Agricultural

traders, (ii) Moneylenders,

(iii) Commercial banks, (iv)

Cooperative societies and (v) Relatives and friends.

The most

convenient source of credit is a moneylender.

It is most

convenient because of the following two reasons :

(i) There is no

need of documentation process while taking loan from informal sources

(moneylenders).

(ii) No

collateral is required. Collateral is an asset that the borrower owns (such as

land,

building, livestock etc.) and uses

this as a guarantee to the lender until the loan is repaid.